In the past we paid our girls allowance. Some questions that I struggled with were: What constitutes a fair allowance? Sometimes the kids don’t help well with chores… what should I do? I teach my kids to pay tithing… beyond that how do I teach them to balance spending and saving money?

Those questions were answered when we switched to a commission system. This idea came from the book, Baby Steps Millionaires by Dave Ramsey. I did not read this book. Tony read it. At his suggestion I read chapter 7 titled, “Will Wealth Ruin My kids?” I learned a few things and put them into practice that very day. My mindset shifted and our world is forever changed!

In the book, Dave teaches, “Kids need to know and understand money comes from work. The more they work the more they earn.” (page 79) Allowance is a handout. In the long run handouts diminish the value of money earned by hard work.

He continues, “Not every household chore needs to be paid for. There should be a balance between doing work for commission and doing work because your kids are simply a part of the family. Learning how to take personal responsibility, clean up after themselves, and do extra helpful things for others in the family goes a long way in setting kids up to win a future team members or leader.” (page 80)

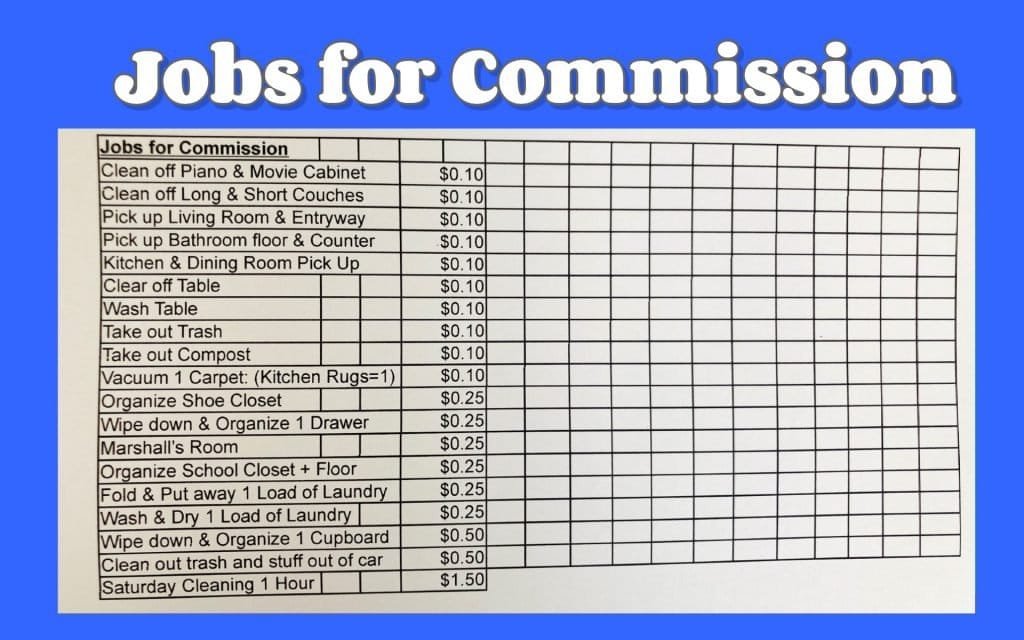

I came up with a list of responsibilities and a list of jobs for commission. It is FAR from perfect. These lists are a constant work in progress, and I trust that with time a good balance will be mastered.

When an unlisted job needs completed I tell the girls the job and how much it will pay. For example the other day one girl deep cleaned the microwave and the other washed and polished the dishwasher.

Saturday Cleaning is one hour of deep cleaning. We mop the floors, scrub bathrooms, dust, vacuum bedrooms, and anything else that needs deep cleaned. After an hour the kids are finished. At first, a lot of instruction happened during Saturday cleaning, but with practice Saturday cleaning has become very smooth and efficient!

Payday happens once Saturday cleaning is complete. Commission pay at our house is small, but it adds up. The girls each average about $4/week.

Our list has changed a lot, and it will continue to evolve. The girls’ enthusiasm has increased with the knowledge that they will be paid for working.

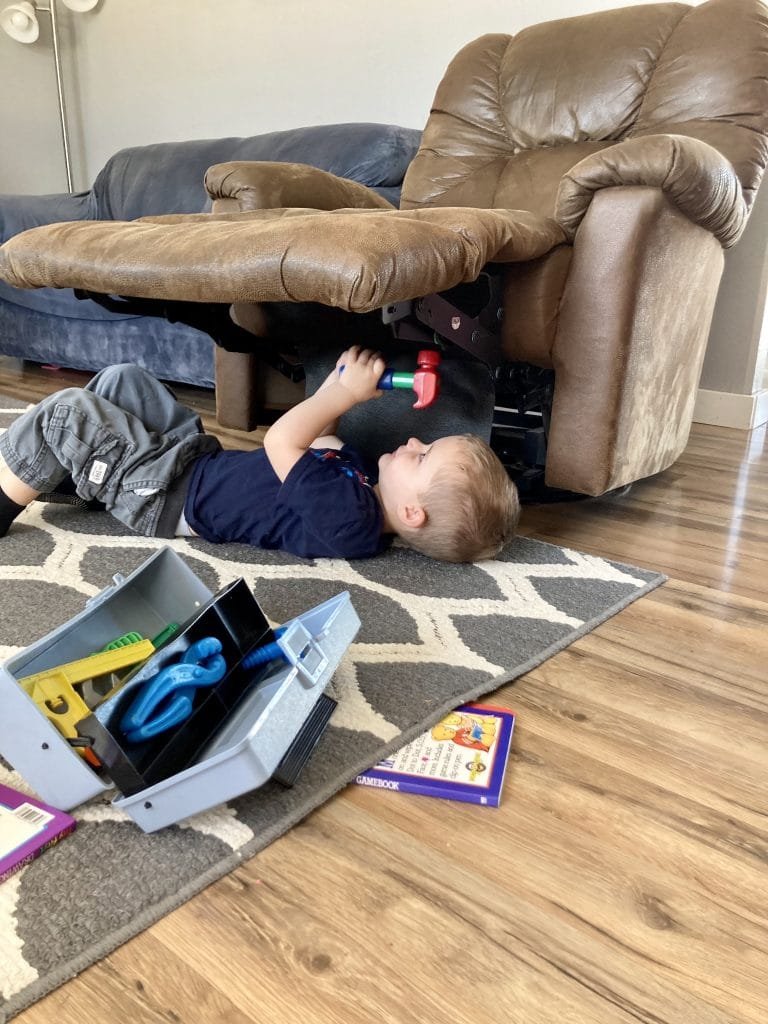

A tornado hits during school. We call that sweet tornado…

Marshall.

As a result, our big clean up follows daily school work.

Previously the call to clean up was met with groans and complaints… Now I say, “Time to do commissions.” The girls enthusiastically help tidy the house. MUCH less nagging, greater responsibility, and more peace has increased unity in our home!

In his book, Dave Ramsey says, “When you teach your kids to plan, set goals, and earn and save money, you’re giving them tools to win at life. And before you know it, that five year old saving for a favorite toy will grow to be a poised, confident, and mature adult with a savings account.”

Before, I didn’t know how to direct my children to spend their money. In my mind, little toys were a waste of money. The paragraph above helped me understand children should save for something they want. They need to save their money over a length of time and practice self discipline.

NOW we encourage our children to pay 10% tithing, save at least 20%, and save the remainder for something they want to buy. The girls have wanted a pocket knife for a long time! Tony used this opportunity to teach them buying a quality item will stand the test of time even if it costs a little more upfront. He convinced them to save for a higher quality Swiss Army Knife instead of a knock off version of the pocket knife.

One week before Zaylee purchased her pocketknife she had enough money. However, she had failed to put 20% into savings. This was the hardest moment in this process. We could have told her it’s okay and let it slide… This would have been the easy choice. Instead, we used this moment to reinforce the importance of saving and putting money away for future goals.

Many tears were shed as our sweet 7 year old placed her $1 in her savings envelope. Waiting the extra week, she diligently worked until she had $22.77 in her wallet. She was excited to purchase the Swiss Army pocket knife.

The second hardest part was when Zaylee earned her $22.77 a week before Jozlin. Zaylee had received some birthday money in March which put her a little ahead.

Life is not fair.

Jozlin worked hard and counted down the days until the next pay day. Both girls are now the PROUD owners of a genuine Swiss Army pocket knife made in Switzerland!

It took approximately 2 months to save enough money to buy this pocket knife.

They are excited to save for their new goal. Zaylee wants to buy a camera and Jozlin wants to buy a smart watch.

BEAUTIFUL results of the commission system:

1.) Our children are learning the value of money.

2.) They understand money comes as a result of working.

3.) Because they worked to purchase the pocket knife it holds a greater value to them.

4.) They are more aware of the value of things around them.

5.) They are learning the principles of delayed gratification and self discipline.

6.) CONSISTENTLY saving money adds up rather quickly. What an awesome truth to learn while they are still young.

7.) They are learning a VALUABLE lesson that it does not hurt PLUS it builds character to wait patiently while you save money to buy something you want.

It’s never too early (or too late) to teach your children to be fiscally responsible. We are definitely imperfect and our system may not be the best. Begin where you are today. Teach your children to be in charge of their own finances.

💕Terynn

Have you read/listened to Smart Money Smart Kids by Dave Ramsey and his daughter Rachel Cruz? I really struggled with paying our kids for chores that I felt should be done solely because they are part of the family, but allowance was never an option. Yet we wanted to teach our kids how to wisely use their money. This book really helped me be okay with paying for certain chores while others are not. Such a great way to help teach our kids financial responsibility! So proud of your girls and you and Tony. It is hard to not just give our kids whatever they want but so good to see them reach their goals and grasp the concept of pride knowing they worked hard and earned it themselves!

I haven’t read that but it sounds fantastic! I will have to read it. You are doing a great job with your children; keep up the great work Rebecca! Thank you!